This article gives you eight concrete, simple to implement actions that will help your company end 2020 profitably.

1. You MUST have profitability. Not profits. Not losses. Profitability.

What’s the difference? You can have profits one month and losses the next month. Or, profits one year and losses the next year. Avoid swings between profits and losses. Profitability is continuous profits.

Profitability gives you the ability to generate the cash needed to survive and grow. Profitability gives you the ability to experience freedom to do the things you want.

2. You MUST save cash.

Even though some of you got the PPP loans, it took two months to get them approved. You need at least three months of operating cash in a savings account at all times. How do you do it? Save a minimum of 1% of every dollar that comes in the door (and to rebuild your savings I suggest 2%).

What if you don’t have the profitability to save cash? This means that your net profit per hour is negative or less than you could earn working at a fast food restaurant. (Net profit per hour is net operating profit divided by billable or revenue producing hours). First, increase your net profit per hour to at least minimum wage (and more if you can do it).

Once you determine the revenues you need for your minimum net profit per hour, increase your selling price by an additional 2%. Save the additional 2%.

3. No more than 20% of your revenues from one customer or one industry.

My client had 80% of his revenues from the restaurant industry. Then the pandemic hit. No revenues. What did he do? He found companies who were still operating and got customers in those industries. This saved his company.

The same might be true if more than 20% of your revenues come from one customer. Suppose that customer goes bankrupt? Suppose one of your employees really screwed up and you lost that customer? Spread your customer base around many customers.

4. Go through your proposals, quotes and tickler files.

My client did this at the end of March when he laid off his dispatcher. He found $80,000 in work that people wanted done immediately. That saved many people from being laid off.

Even if a proposal is a year-old, contact that customer. There may have been many proposals that you presented last year where the customer did nothing. Now is the time to get the customer to say yes. Be prepared to answer the question, “Is the price still good?”

5. Reactivate inactive customers.

How many customers are in your database that have not done business with your company in 19 months to 5 years? It’s time to contact them and give them a reason to do business with your company again. They have bought from your company in the past. There is some trust and familiarity.

6. Have a contest.

It’s much more fun if you don’t have to think up all the ideas yourself. Have a contest with the whole company. Determine the decrease in revenues for the past two to three months. That should be the basis for the contest.

For example, if you lost $250,000 in revenues during the pandemic shutdown, and your normal budget for May through August is $1,500,000, the company needs to generate $1,750,000 for May through August.

How can that happen? What can the company do to achieve this new revenue goal?

Let everyone come up with ideas. Put the needed revenues on a chart where everyone can see them. Break the total into weekly goals. Weekly reporting keeps everyone excited about meeting the goals.

Assuming the company meets the goal, take everyone, including spouses/significant others, out for a steak dinner (or other dinner at a great restaurant). Pay for the babysitters. This should be a fun evening for everyone.

7. Managers share needed revenue and costs with their team.

Each team member should understand that the customers write their paychecks. Without customers there is no revenue to pay them.

Once team members understand this, then they should understand their cost (i.e. how much revenue is necessary to pay for their salary, benefits, and overhead) and how that team member contributes to the bottom line.

Revenue producing teams must generate the sales to cover the non-revenue generating team members which support them. For example, a sales team needs someone to track the sales, ensure that they are delivered, do the marketing, etc. These are non-revenue producing team members who make it easier for the revenue producing teams to do their jobs.

Each team must be profitable or it is likely not to survive a round of layoffs.

Team members should be asked what they can do to cut costs. Implement their suggestions whenever possible and feasible.

8. Understand cash flow and create a cash flow budget through December, 2020

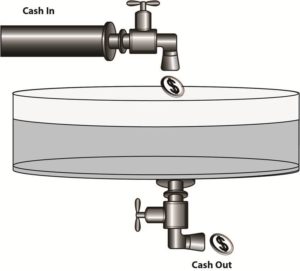

First, cash flow. The figure shows a spigot on top and a drain out the bottom. In between is the tank of water. Assume the tank holds money instead of water.

There is a certain level of money in the tank when you start the day, the week, the month, or the year.

You open the spigot and you receive cash from collections of sales. You might also receive interest on savings, borrowing from a credit line or other source, or you might sell an asset. The level of money in the tank rises.

Then you open up the drain to pay your bills, payroll, rent, etc. The level of money in the tank lowers until all the payments have been made and the drain is closed.

Then the process starts over again.

Next create your revised profit and loss statement.

This should be a realistic view of what you expect for the rest of 2020. Create your updated P&L to show at least a net profit per hour equal to what you can earn at a fast food restaurant.

Finally, create your cash flow budget which is dependent on your P&L budget.

The first time you create a cash flow budget might be a little frustrating. It will become easier as you do it repeatedly.

Send me an email (rking@ontheribbon.com) If you would like a copy of a sample P&L and cash flow budget.

You can survive and thrive after this pandemic. Make sure you have profitable sales, a strong maintenance program, save money, and watch your cash!